Surety bonds are essential for many businesses and professionals in various industries across the United States. Whether you’re in Florida, Georgia, Texas, or any other state, you may be required to obtain a surety bond to comply with state regulations, fulfill contractual obligations, or engage in specific professions. In this comprehensive guide, we’ll walk you through the step-by-step process of applying for a surety bond, with customized insights for different states to ensure you meet the legal requirements of your location.

What is a Surety Bond?

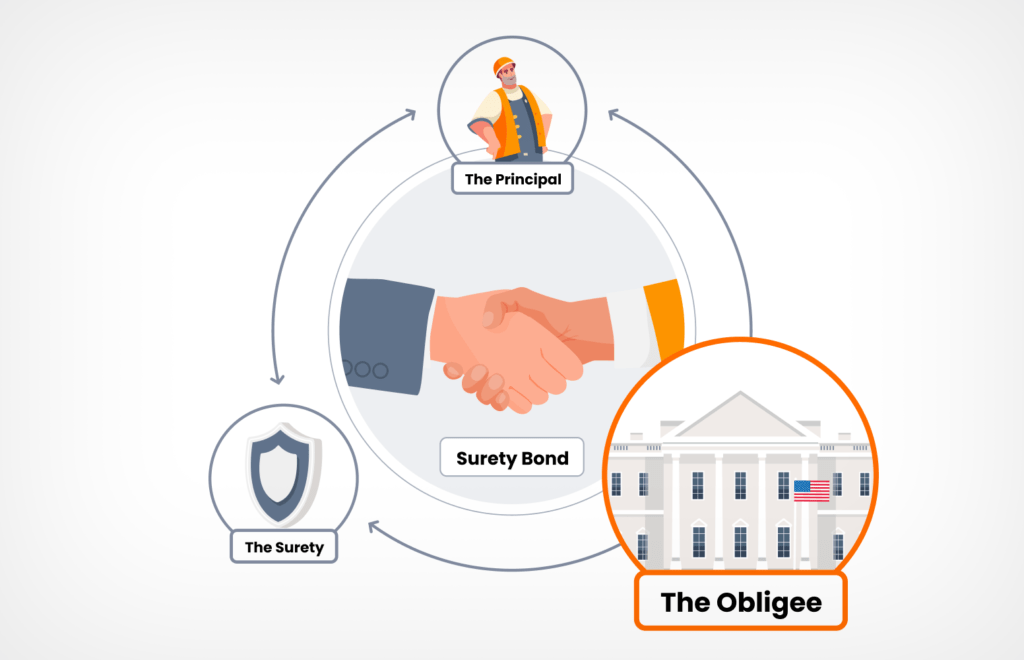

A surety bond is a three-party agreement involving:- Principal: The individual or business required to obtain the bond.

- Obligee: The entity requiring the bond, usually a government agency, company, or project owner.

- Surety: The bonding company that guarantees the principal’s obligation will be fulfilled.

If the principal fails to meet the terms of the agreement, the obligee can make a claim against the bond. The surety will cover the loss, and the principal must repay the surety for any claims paid.

Why Do You Need a Surety Bond?

Surety bonds are often required by law, particularly in the construction, auto dealership, and freight brokerage industries. They protect the public, consumers, or clients from financial loss if a company or individual does not fulfill their obligations. The type of bond you need depends on your industry, location, and the specific requirements outlined by government agencies or project contracts.

Step-by-Step Process to Apply for a Surety Bond

Step 1: Determine the Type of Surety Bond You Need

The first step is identifying the type of bond required for your business or profession. Some of the most common types of surety bonds include:

- License and Permit Bonds: Required by state or local governments to legally operate certain types of businesses.

- Contract Bonds: Used in the construction industry to guarantee that contractors will fulfill their contractual obligations.

- Court Bonds: Required for specific legal proceedings, such as probate or appeal cases.

- Fidelity Bonds: Protect businesses from losses due to employee dishonesty, such as theft or fraud.

For example, if you are opening an auto dealership in Texas, you may need an Auto Dealer Bond to comply with state laws. In Florida, contractors bidding on public projects will typically require a Performance Bond and a Payment Bond to guarantee the project’s successful completion.

Step 2: Check State-Specific Requirements

While surety bonds are required in every state, the exact bond amounts, types, and conditions can vary. Here’s a breakdown of the bond requirements in Florida, Georgia, Texas, and other states.

- Florida: In Florida, surety bonds are commonly required for contractors, auto dealers, and professionals in the construction industry. The Florida Construction Industry Licensing Board mandates contractors to obtain a Contractor License Bond. Auto dealers must secure an Auto Dealer Bond ranging from $25,000 to $50,000 depending on the type of dealership.

- Georgia: Georgia also has specific bonding requirements for industries like auto dealing and contracting. For example, a General Contractor License Bond is required for construction professionals, with amounts determined based on the type of license. Auto dealers must post a $35,000 bond to operate legally.

- Texas: In Texas, surety bond requirements are similar to other states, but the amounts and specific conditions may differ. For example, Texas requires a $25,000 Freight Broker Bond for freight brokers and a $50,000 Auto Dealer Bond for those selling new or used vehicles.

- Rest of the U.S.: Other states have their specific requirements. For example, California requires contractors to obtain a $15,000 Contractor License Bond, while New York has its own requirements for different professions.

It’s crucial to check your state’s regulations to ensure you meet all the necessary bonding requirements for your industry.

Step 3: Choose a Reputable Surety Company

The next step is selecting a surety company or agent to work with. Not all surety companies are the same, so it’s essential to choose one that is licensed to issue bonds in your state and has a strong reputation in the industry. Look for the following qualities when choosing a surety company:

- Experience: Ensure the company has experience in issuing bonds for your specific industry or profession.

- Financial Strength: Choose a company that is financially stable, as they will need to cover any claims made against your bond.

- Customer Support: A company with a good customer support team can guide you through the application process and help you address any issues that arise.

You can research online, ask for recommendations from colleagues, or consult with a professional surety bond broker to find a reputable company.

Step 4: Complete the Bond Application

Once you’ve selected a surety company, the next step is to complete the bond application. The application process can vary depending on the type of bond and the company, but it generally includes:

- Basic Information: Your business name, contact details, and tax identification number.

- Bond Type and Amount: Specify the type of bond you need and the required bond amount.

- Financial Information: Some bonds, particularly high-risk bonds like performance or payment bonds, may require you to submit financial statements, credit reports, and other supporting documentation.

- Background Information: You may be asked for details about your business history, previous bond claims, and any relevant licenses or permits.

Make sure to provide accurate and complete information, as errors or omissions can delay the approval process.

Step 5: Underwriting and Approval

After submitting your application, the surety company will conduct an underwriting process to assess your risk level. During this process, the surety evaluates factors such as:

- Credit Score: Your credit history is a key factor in determining your bond premium. A higher credit score usually results in a lower premium.

- Financial Stability: The surety will review your business’s financial strength, including income statements, balance sheets, and cash flow.

- Industry Experience: For contract bonds, your experience in completing similar projects may be considered.

If you have poor credit or financial issues, you may still qualify for a bond, but the premium may be higher. In some cases, you might be asked to provide additional collateral.

Step 6: Receive Your Quote and Sign the Agreement

Once the underwriting process is complete, the surety company will offer you a bond quote. This quote includes the premium, which is typically a percentage of the total bond amount (usually between 1% and 10%).

Review the terms of the bond carefully before agreeing to the premium. If you’re satisfied with the quote, you’ll sign an indemnity agreement, which legally binds you to reimburse the surety company for any claims paid out on your behalf.

Step 7: Pay for the Bond

Step 8: File the Bond with the Appropriate Agency

In most cases, you’ll need to file the bond with the government agency or entity that required it. This could be a state licensing board, a court, or a project owner. Be sure to file your bond promptly, as failure to do so can result in delays, fines, or the inability to start your project or business.

Renewing and Maintaining Your Surety Bond

Most surety bonds are valid for a set period, often one year. After the bond expires, you’ll need to renew it to maintain compliance with the law or continue working on your project. Your surety company will typically notify you when it’s time to renew and provide instructions on the renewal process.

If your business or financial circumstances change, your bond premium may increase or decrease during renewal.